How To Find Vendors For Your Business

Many small businesses hire short-term workers or bring on independent contractors to complete projects. Hiring vendors is a corking way to go an skilful to aid out your concern simply properly accounting for expenses and their labor is disquisitional.

QuickBooks gives you the tools to track these expenses and file 1099-MISCs for your independent contractors. This commodity's goal is to set you upwards for success, both for bookkeeping and legal reasons.

You may be asking yourself, "Why do I demand to rail 1099 independent contractor payments separately?" Well, let me tell you! Separating regular employee payments from contractors is crucial because of the type of work they do and their relationship to your business. Contractors are on-demand or self-employed and practice work for yous but are not your official employees. Because of this, you need to report contained contractor compensation on a 1099 MISC. From financial and legal standpoints, the division needs to be clear.

Additionally, knowing whether someone should or should non be classified as an contained contractor tin can exist complicated. Intuit has a tool that can aid explain the deviation betwixt a 1099 and a Westward-ii worker . If you are unsure, attain out to a tax professional or what we phone call the source of truth: the IRS website .

The Expenses tab is one identify where yous can create vendor profiles . If you want to enter your 1099s data yourself, this is the identify for you! Go to Expenses>>Vendors and then click on New Vendor .

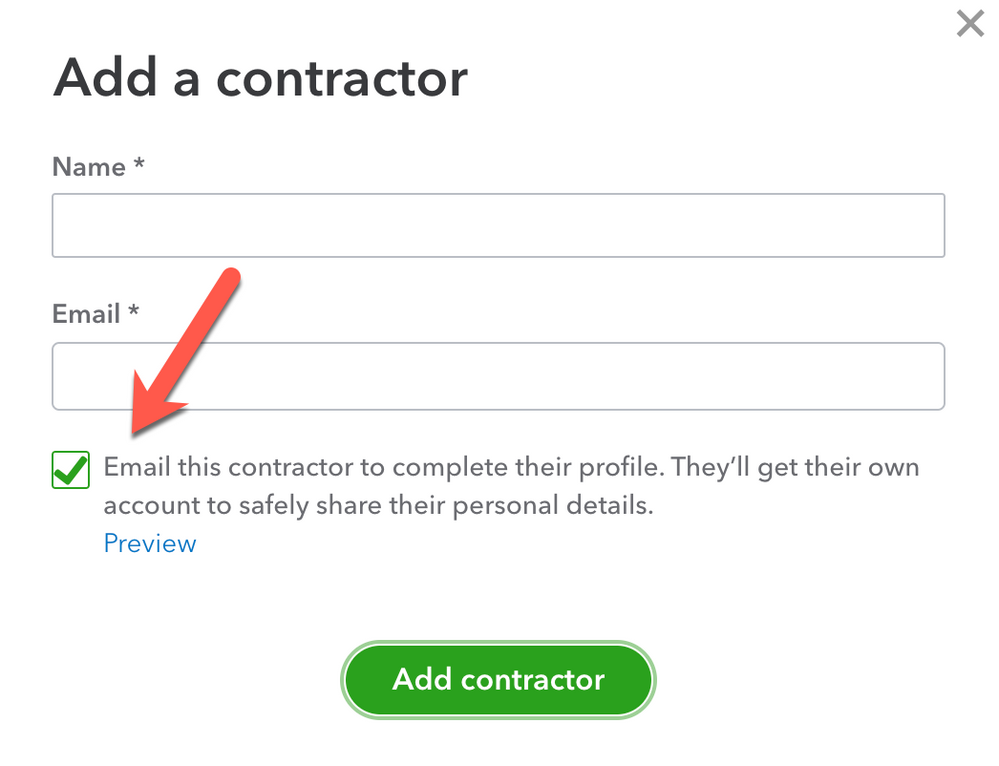

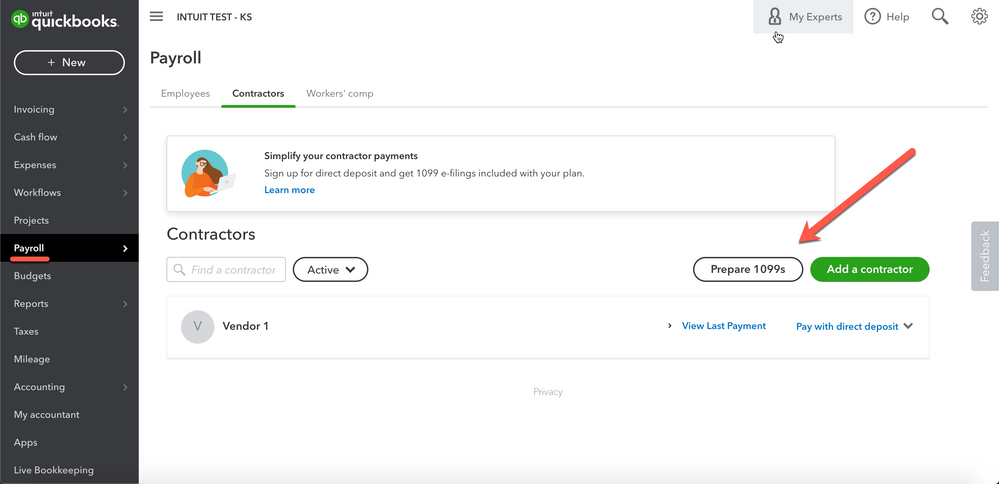

You can also create and manage records for your independent contractors in the Payroll Tab . In QuickBooks Online, you can notice your contractors here since they, like your employees, are individuals you pay. Here y'all have the option to email your vendors and have them fill out the information themselves.

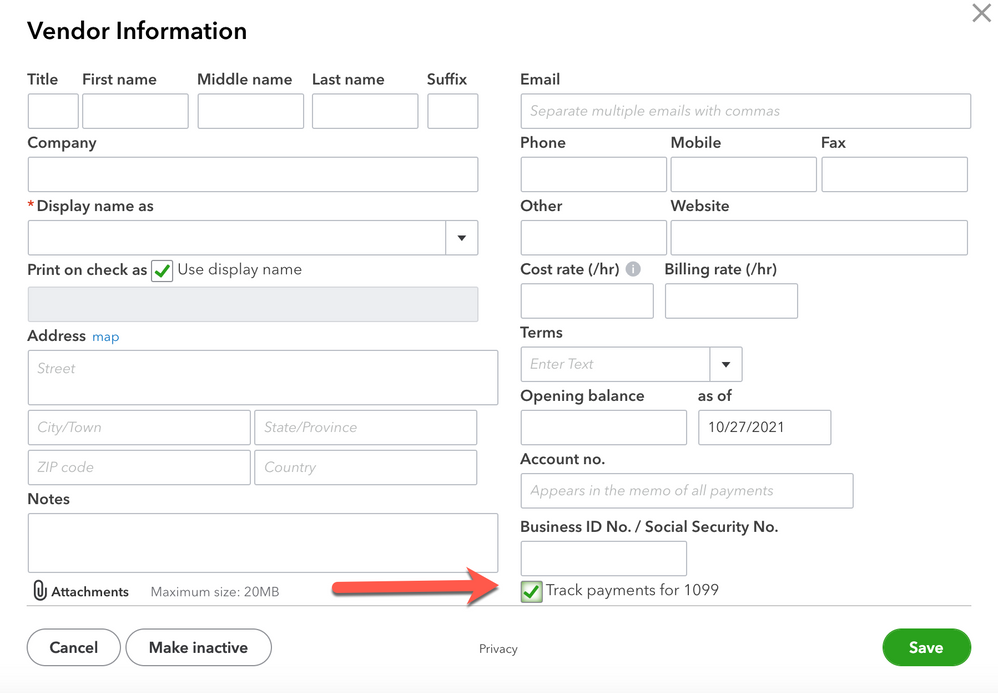

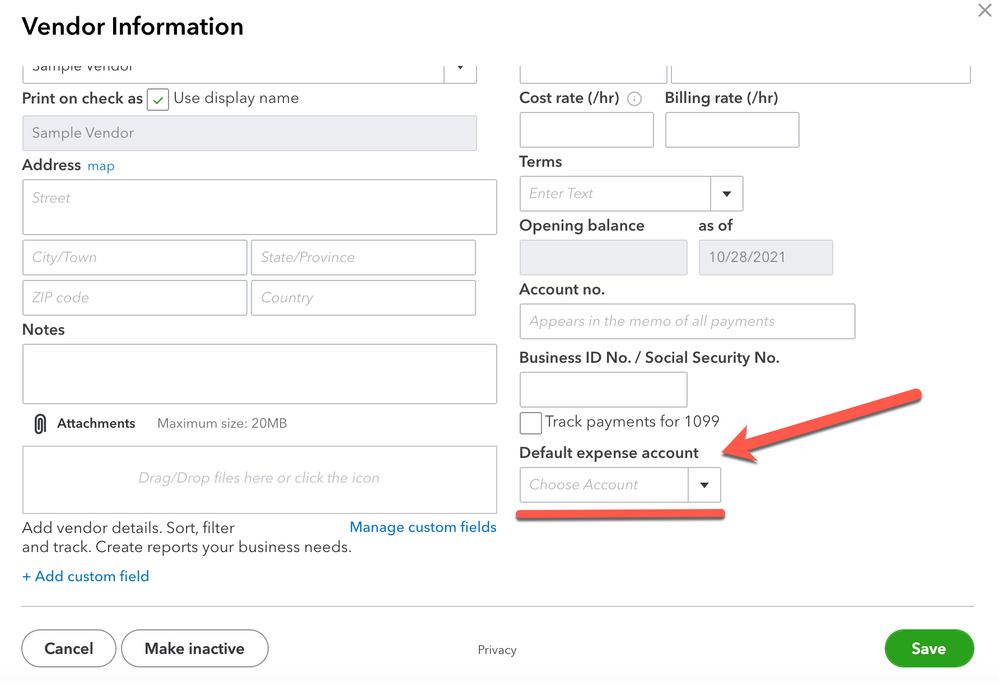

Permit's have a look at the Vendor Information window more closely. You fill out a lot of the same information for vendors as you do for employees. Ane difference is the EIN (employee's Identification Number) which is entered on the Business concern ID line. If you have this number, you'll want to make full information technology in. If non, you can add it after but recall to do and so earlier it's time to file.

There'south too a checkbox to Track payments for 1099s. Once checked, QuickBooks will add the independent contractor to the revenue enhancement filing module.

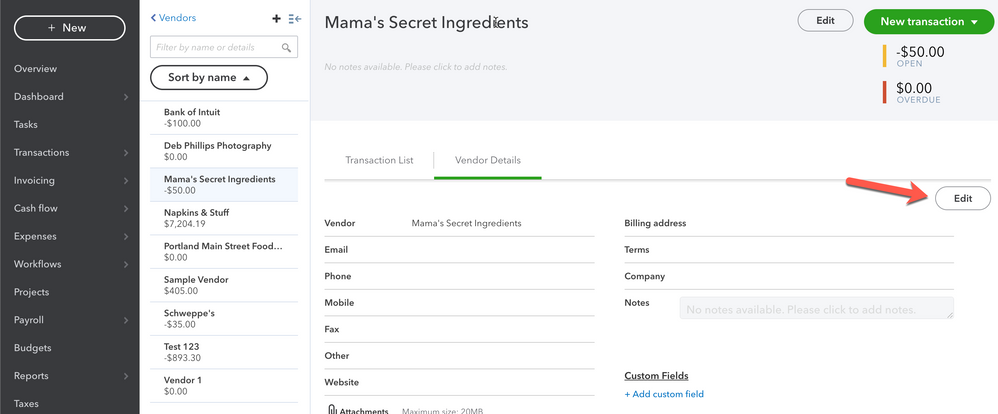

Before going any farther, click on your new contractor'southward proper noun and make sure all the data is right. Pay close attention to their EIN and email address if you plan to send their 1099-MISC electronically.

As always if you need to make whatever changes, click on the vendor's name and then Edit .

Note: You tin use this exact same procedure to track an existing vendor for a 1099-MISC. Remember, you will have to dissever the expenses associated with products and services you buy from the vendor versus expenses related to their contract labor. Exist very deliberate well-nigh which account you map expenses to on Expense forms.

You can run into within the vendor profile where you can add together a default expense account.

We'll use this for payments fabricated to contained contractors. This footstep is especially of import for vendors you also buy products and services from. As mentioned above, expenses for products and services need to be differentiated from the work they do.

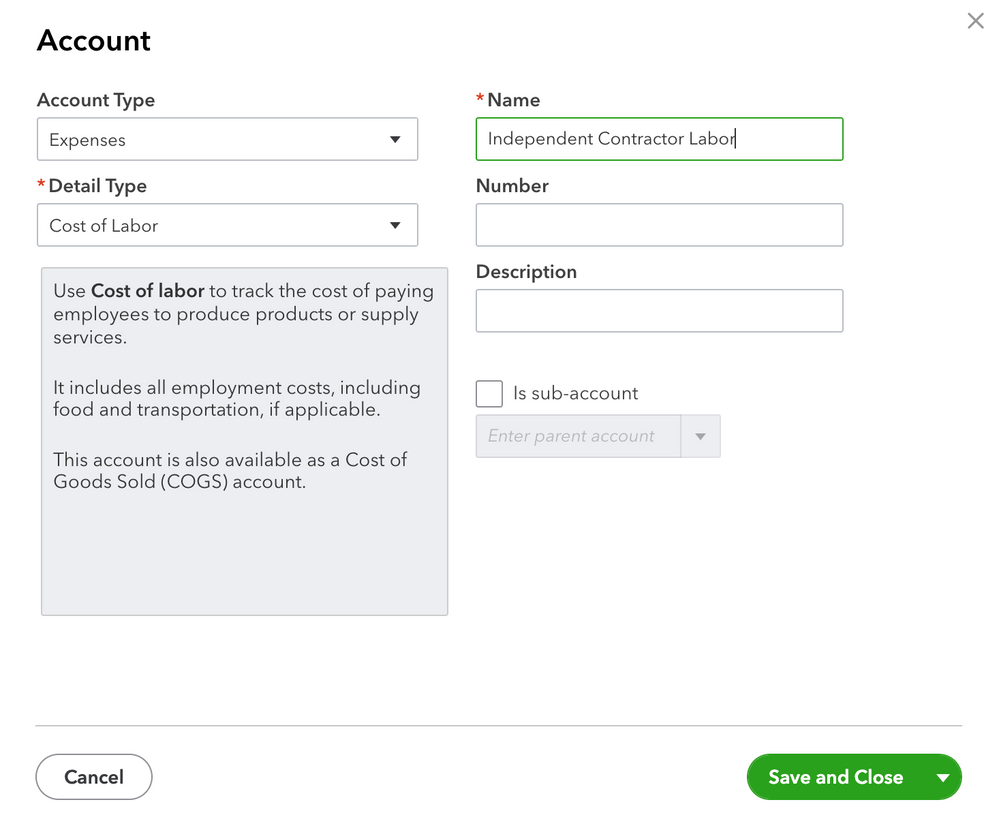

Go to the Accounting tab and click on your Chart of Accounts . Create a new business relationship like the i pictured below:

- Proper name the business relationship Contained Contractor Labor or something else that makes sense and is easy to call up

- Select Expenses as the Account Type and Cost of Labor as the Detail Type

- From now on, every fourth dimension you lot enter an expense or pay a check to your independent contractors, map those transactions to this new Expense account.

Since yous've been tracking their payments exclusively with that special contractor Expense Account, filing the 1099-MISCs will exist a slice of cake.

In Pace ii of the Prepare 1099s module, select Box 7: Nonemployee Compensation. Choose the business relationship you used to pay your contractors. This tells the IRS what money was used for not-employee bounty.

In Step 3 , the Vendors y'all started tracking will automatically announced on the list. If you don't see one of your contractors, simply edit their profile using the steps above and choose the Rails payments for 1099s checkbox. Complete the module and you lot're prepare to send out 1099-MISCs to your independent contractors.

Tips and Reminders:

- Ever be aware of which Expense account y'all're using when y'all enter expenses related to independent contractors.

- Use the memo and clarification fields to further document what these types of expenses are for so you won't accept to guess during the rush of tax season.

- What's most important is knowing which expenses apply to the 1099-MISC. This is no easy chore, only the IRS website provides a comprehensive list you tin use equally a reference.

- If you already entered labor expenses for a Vendor into a unlike expense business relationship before going through this process, become dorsum and recategorize those transactions into the new "Independent Contractor Labor" business relationship.

In that location y'all take it! We went from setting up contractors to expense forms to filing for 1099s. I hope this was helpful and gave you an in-depth overview of how QuickBooks Online handles vendors. Every bit always, reach out to the Community if you accept questions. We're here to assistance!

Source: https://quickbooks.intuit.com/learn-support/articles/getting-the-most-out-of-quickbooks/how-to-add-independent-contractors-and-track-them-for-1099s-in/05/966483

Posted by: careydrife1958.blogspot.com

0 Response to "How To Find Vendors For Your Business"

Post a Comment